Startup Teams

Attracting Talent & Assembling Startup Teams

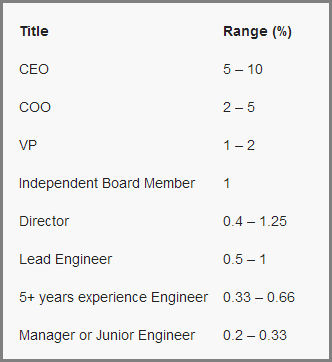

Roles and Titles in a company

- CFO

- CXO

- EVP, SVP, VPs

- Director of ...

- General managers

- managers

- engineers, technicians, accountants, admins ...

Usually, 6 - 12 for each manager to oversee, ideal number is 6 or 7, for smaller company.

Typical product company Hire people & set up Co. -> Design -> Build Inventory -> Sale closed -> Collect Cash

You need cash to make sure the biz run, for example, when you build an inventory for 1 million, but the sales maybe sell in 30 days, and collect money 60 days later, you need 90 days money. A lot of the companies run out of biz because they success. For example, the finger print companies.

Timing of Capital Idea discovery & mkt Research -> Pre-Seed -> Prototype -> Seed -> Prod Dev -> Startup funding -> Prod Delivery & customers -> Expansion funding -> Scaling & Channel

Money resources

- Friends & family - $10k to $100k

- Angel investors - $200k to $2m

- Early stage VC - $2m to $10m

- Late stage VC - $10m to $50m

- PE or IPO - $50m to $1b

IPO is nothing, but another financial event as finding a VC, but from general publics

Factoring market, is that when you get an order, and you can take to them, they will take the risk of not paying or paying, but they will charge 10%

Dilution, as you issue shares, the denominator is increasing.

company value = stock price * number of shares

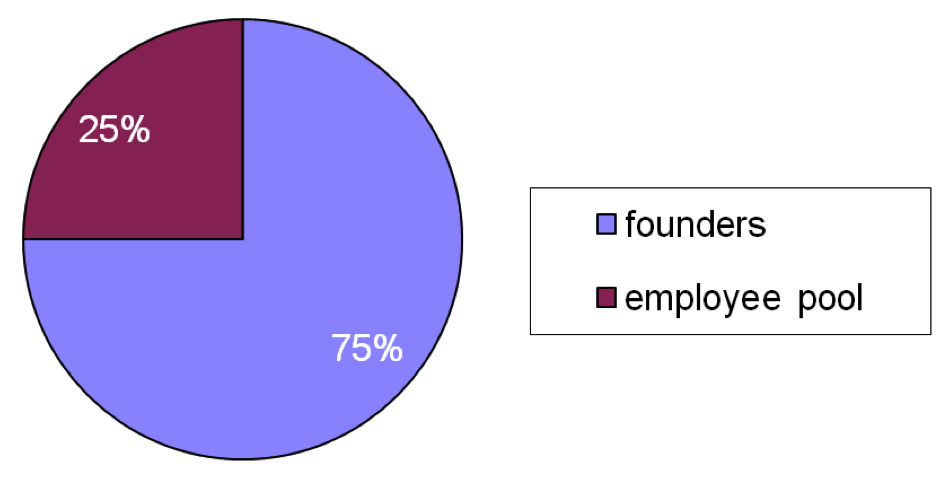

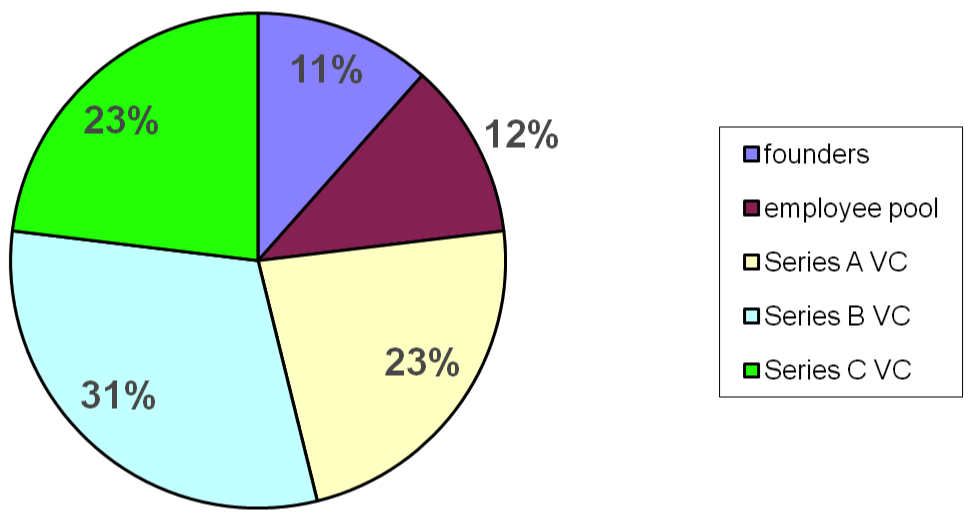

The usual Equity Distribution is shown as the following figure for a startup.

Example

If we have 3 people start a company

- Before investment

- 10M shares issued

- Each founder has 25% (a total of 75%), reserve 25% for employees & advisors

- Price $0.01 (this will resulting in company valuation of $100k)

- Now the Equity Ownership is shown in the following figure:

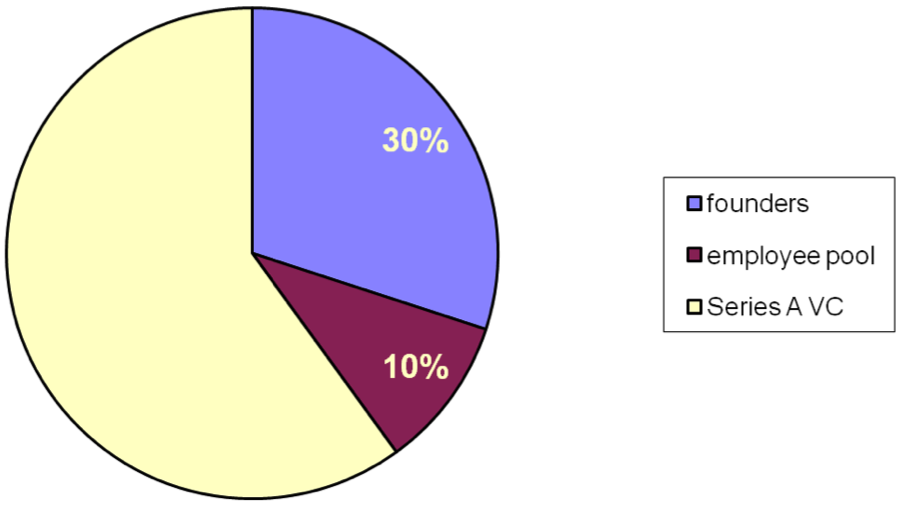

- 1st round investment (series A, product development)

- Pre-money valuation ~$2M (this will be done by agreement with Investors)

- Per share price = $2M/10M shares = $0.20

- Investors put in $3M (buy shares at $0.20) -> 15 M new shares will be issued

- Post money is $5M ($2M pre + $3M new money), investors own 60% of the company now.

- Total number of shares = 10M + 15M new = 25M

- Now the Equity Ownership Post Round A is shown in the following figure:

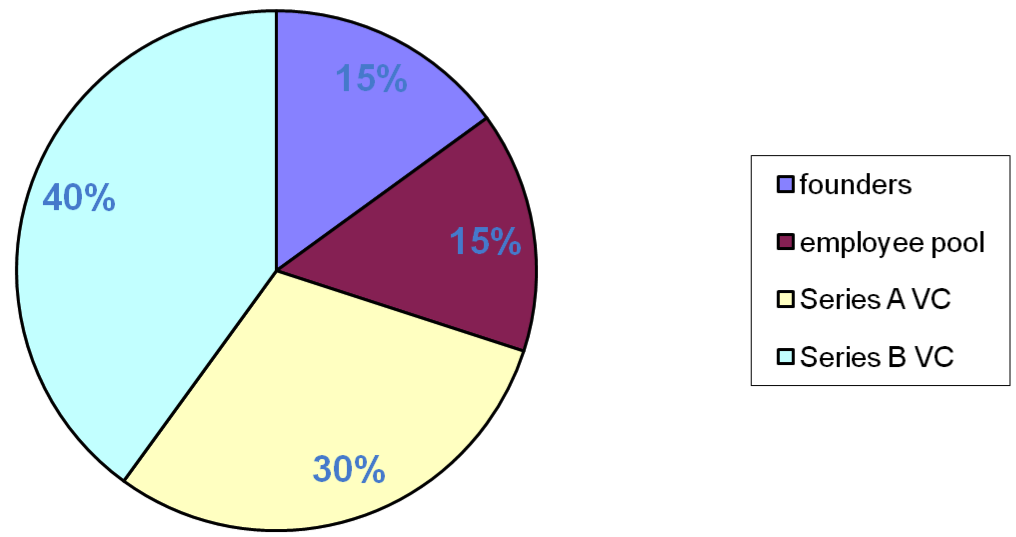

- 2nd round investment (Series B Product deployment)\

- Pre-money valuation ~$10M

- New per share price = $10M/25M = $0.40

- Investor put in $8M (buy shares at $0.40)

- New 20M shares issued ($8M/$0.40)

- Total 45M shares (existing 25M + new 20M)

- Post money is $18M - everyone gets diluted, they all get smaller share of a bigger pie

- If the board decide to add 5M shares to Employee pool (ESOP)

- Now the Total shares = 50M

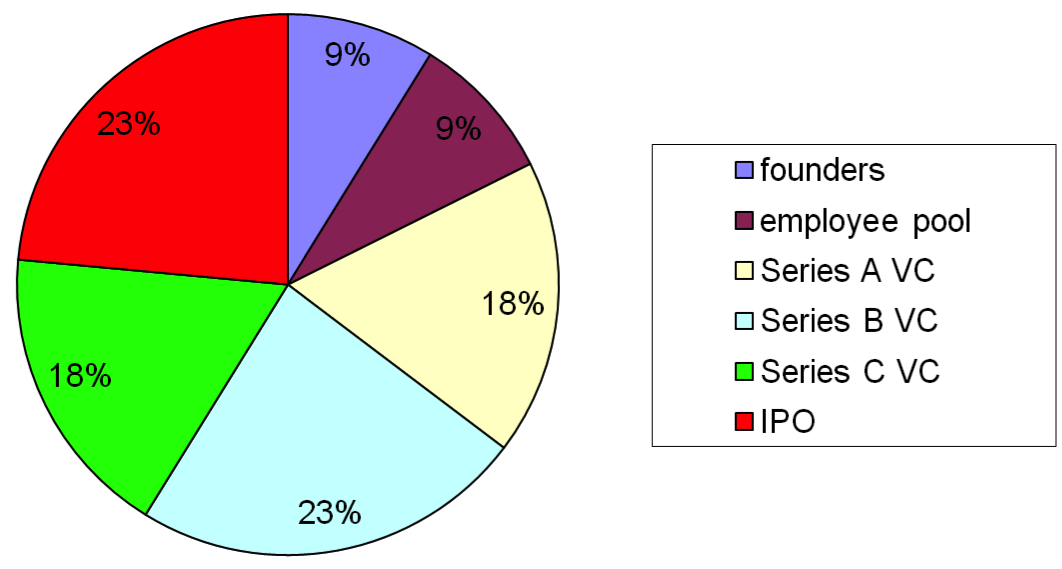

- Now the Equity Ownership Post Round B is shown in the following figure:

- 3rd round investment (Series C, channel expansion)

- Pre-money valuation ~$50M

- New per share price = $50M/50M = $1.00

- Investors put in $15M

- Post money is $65M - everyone continues get diluted

- 15M new shares issued (total 65M)

- Now the Equity Ownership Post Round C is shown in the following figure:

- Initial Public Offering (IPO)

- Valuation by investment bankers ~$100M

- Reverse split shares 5:1 to get decent price at IPO

- Market usually needs to see stock price in the $6 to $18 range

- Now 65M outstanding shares become 13M but they are 5x more valuable

- 13M shares pre IPO

- Sell 2M new shares at IPO at $100M/13M = $7.70/share

- Raise $15.4M for operations (less fees)

- Employee lockup

- Founder lockup

- Now the Equity Ownership after going public is shown in the following figure:

We can also see at different stages, the founders' ownership is diluted, but the total value is increasing.

| shares | Price | Ownership | Value | |

|---|---|---|---|---|

| Founding | 7,500,000 | $0.01 | 75% | $75,000 |

| Series A | 7,500,000 | $0.20 | 30% | $1,500,000 |

| Series B | 7,500,000 | $0.40 | 15% | $3,000,000 |

| Series C | 7,500,000 | $1.00 | 11% | $7,500,000 |

| at IPO | 1,500,000 | $7.70 | 9% | $11,550,000 |

Vesting

Vesting is an interesting concept to protect early companies. For example, if you have a co-founder who have 50% shares of the company. But he left the company within a year of the start of the company. After a few years, you sell the company for $200M, do you need to give your co-founder $100M? The answer is no, because of vesting.

Vesting is an interesting concept to protect early companies. For example, if you have a co-founder who have 50% shares of the company. But he left the company within a year of the start of the company. After a few years, you sell the company for $200M, do you need to give your co-founder $100M? The answer is no, because of vesting.

Vesting means that at the very beginning each founder gets his or her full package of stocks at once to avoid getting taxed for capital gains; but the company has the right to purchase a percentage of the founder's equity in case he or she walks away. This means that if your partner walks away after a couple of months, he or she will not be able to claim those 100 million dollars because the company purchased his or her equity when he or she left the company. In essence, vesting protects founders from each other and aligns incentives so everybody focuses towards a common goal: building a successful company. -- from Here.

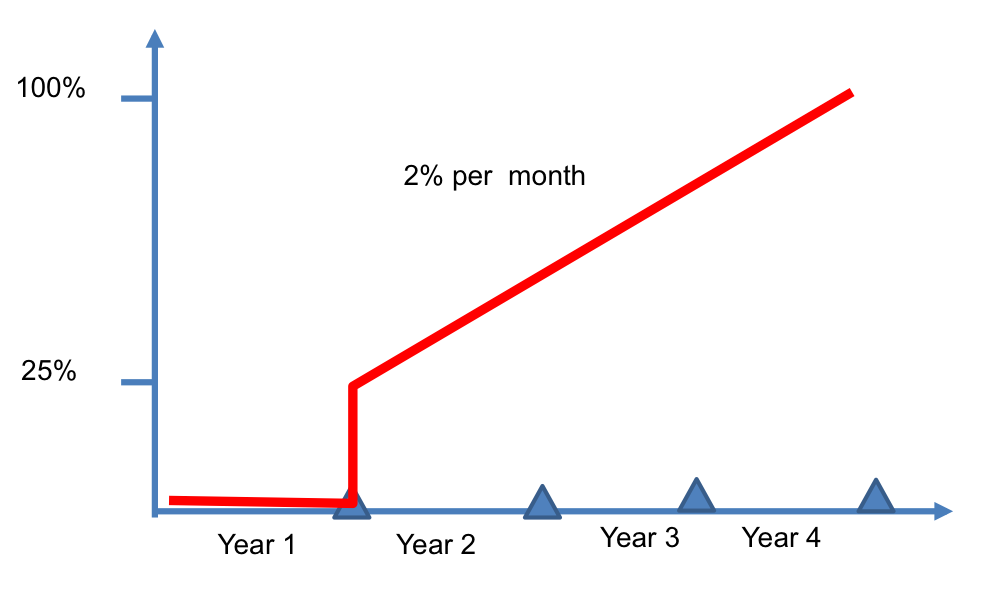

For example, the following figure shows you how vesting works. Standard vesting clauses typically last four years and have a one-year ‘cliff’. This means that if you had 50% equity and leave after two years you will only retain 25%. The longer you stay, the larger percentage of your equity will be vested until you become fully vested in the 48th month (four years). If your co-founder leave within a year, he or she will have nothing,

Building a team

What do you look for in a team?

- Passion

- Hunger

- Alignment of vision

- Technical competence

- Leadership ability (earn other's respect)

- Prior experience matters less

Board of Advisors

- Domain experts

- Market experts

- Channel experts

- Technology experts

- Personal coach & mentor

- Celebrity

Board of Directors

- Fiduciary responsibility

- Come with money

- unless their name will generate extreme credibility

- Limit size & be very choosy

- No family or relations

Case study - Vermeer Technologies

This week we discussed the Vermeer Technologies case.

For this study case, it shows how important to select the best team members for a startup. At last, the VCs don't want the founder to be the CEO because he didn't have the operational experience before, but he really wants to, how he will decide? To go or not to go?

What's the difference between begging and negotiating? Leverage, his answer is 'Yes, I agree with you, I don't have the experience, we can have a new CEO, but let me be part of it. I can be the temporary CEO for 9 months, while we are looking for a new CEO. We don't have new strategy for the next 9 months, and no one knows the company better than me'. Remember, the last thing VC wants to do is to find a new CEO.

When we interview someone, we should give them the feeling of special. If you give the offer to soon, they may think it is cheap. One example is from the instructor, when he had interviews with his previous company, he interviewed many candidates, but none of them is good enough. One day, he met two really good candidates, and he gave them offer soon after the interview, but both of them refused the offer. Because they didn't feel they've been chosen. Therefore, making some difficulties for them is good.

Acknowledgements:

All the materials are from the entrepreneurship class at UC Berkeley taught by Naeem Zafar.

Five weeks ago my boyfriend broke up with me. It all started when i went to summer camp i was trying to contact him but it was not going through. So when I came back from camp I saw him with a young lady kissing in his bed room, I was frustrated and it gave me a sleepless night. I thought he will come back to apologies but he didn't come for almost three week i was really hurt but i thank Dr.Azuka for all he did i met Dr.Azuka during my search at the internet i decided to contact him on his email dr.azukasolutionhome@gmail.com he brought my boyfriend back to me just within 48 hours i am really happy. What’s app contact : +44 7520 636249

ReplyDeleteStartup valuations offer insight into a company’s capability to use new capital to grow, meet customer and investor expectations, and hit the next milestone. A startup valuation may account for factors like your team’s expertise, product, assets, business model, total addressable market, competitor performance, market opportunity, goodwill, and more. Contact Us: +91 8929218091

ReplyDeleteDR EMU WHO HELP PEOPLE IN ANY TYPE OF LOTTERY NUMBERS

ReplyDeleteIt is a very hard situation when playing the lottery and never won, or keep winning low fund not up to 100 bucks, i have been a victim of such a tough life, the biggest fund i have ever won was 100 bucks, and i have been playing lottery for almost 12 years now, things suddenly change the moment i came across a secret online, a testimony of a spell caster called dr emu, who help people in any type of lottery numbers, i was not easily convinced, but i decided to give try, now i am a proud lottery winner with the help of dr emu, i won $1,000.0000.00 and i am making this known to every one out there who have been trying all day to win the lottery, believe me this is the only way to win the lottery.

Dr Emu can also help you fix this issues

(1)Ex back.

(2)Herbal cure & Spiritual healing.

(3)You want to be promoted in your office.

(4)Pregnancy spell.

(5)Win a court case.

Contact him on email Emutemple@gmail.com

What's app +2347012841542

Website Https://emutemple.wordpress.com/

Https://web.facebook.com/Emu-Temple-104891335203341

Nice blog. Thanks for sharing.Especia is dedicated to providing startup valuation services through numerous business dominions and uses the Startups Valuation Methods. A startup with less or nothing as income and profits and the future is also not certain it becomes extremely difficult to determine the valuation. Especia is the company with your one-stop-destination in determining the best and most accurate valuation of your startup. The startup valuation services allow the investor to develop an interest in your startup venture. The startup company valuation has benefits such as knowing the startup's market value, near-future plans such as business expansion, and getting investors and lenders. if you need startups valuation services call 9310165114 or visit us Startups Valuation Services

ReplyDeleteNice blog! Really useful information regarding startup financing. Thanks for Sharing.

ReplyDeleteNice Information

ReplyDeleteHisabkitab offers comprehensive bookkeeping services that can help streamline your business's financial management. Our experienced team can handle all aspects of your financial record-keeping, using the latest technology and software to ensure accuracy and efficiency. Contact us today to learn more about how we can help you focus on running your business while we handle the tedious task of bookkeeping

Nice Information.

ReplyDeleteHisabKitab is a leading accounting services provider in Surat, offering a wide range of financial management solutions to businesses of all sizes. Their team of experienced accountants helps clients manage their bookkeeping, tax compliance, financial reporting, and other accounting needs efficiently and accurately. With their commitment to quality and customer satisfaction, HisabKitab is the go-to choice for businesses looking to streamline their financial operations in Surat.

Nice Information

ReplyDeleteGST Consultation Near Me - Hisabkitab" refers to the service offered by Hisabkitab, a company that provides consultation and assistance related to Goods and Services Tax (GST) in India. The service is aimed at businesses and individuals who need guidance on GST compliance, filing returns, and other related matters. The company has a team of experienced professionals who provide personalized solutions to meet the specific needs of their clients. The service is available at various locations across India, making it convenient for clients to access GST consultation services near their location.